The recent escalation of hostilities between Iran and Israel, now involving direct US military action, has created a complex environment for global investors. Over the past few days, markets have reacted with modest levels of volatility but have largely maintained composure, reflecting cautious optimism that the conflict may be contained.

Recent Events & Market Reactions

- US Airstrikes & Iranian retaliation: The US conducted unprecedented airstrikes on three major Iranian nuclear sites over the weekend, with Israel also targeting Iranian infrastructure. Iran responded by launching missiles and drones at Israel and a US base in Qatar, however, the attacks caused minimal damage and were largely intercepted with advanced warning. This retaliation is seemingly more symbolic than an aggressive attack seeking to escalate the conflict.

- Ceasefire Announcement: On June 23, US President Donald Trump announced a “complete and total ceasefire” between Israel and Iran, signaling a potential de-escalation. This announcement came after Wall Street’s trading session and led to a modest uptick in US stock futures and a decline in oil prices. It is uncertain whether this ceasefire will be implemented by all parties at the time of writing.

- Oil Market Volatility: Oil prices initially spiked to five-month highs on fears of supply disruptions, particularly through the Strait of Hormuz where approximately 20% of the world’s oil flows through. However, as it became clear that Iranian retaliation was limited

and oil flows remained uninterrupted, crude prices retreated sharply

— US oil futures swung from above $78 to near $68 per barrel, and Brent crude settled around $72. - Equities & Bonds: US stocks rallied on Monday, with the S&P 500 up 1%, the Dow up 0.9%, and the Nasdaq up 0.9%. Energy stocks notably underperformed. Treasury yields dipped as concerns over rising oil prices impact on inflation subsided. Australian equities have experienced weakness over the previous week’s trading but have reacted positively to recent global market developments and easing fears of market contagion.

- Energy Sector: The initial oil price surge favored energy stocks, but the rapid retreat suggests investors are pricing in a low probability of a sustained supply shock. Energy shares remain attractive as a hedge against future volatility but may see headwinds if the ceasefire holds and supply concerns fade.

- Defence & Aerospace: Defence stocks have remained well supported as geopolitical risk increased, reflecting expectations of sustained military spending and potential new contracts.

- Safe Havens & Currencies: Gold and the US dollar saw intermittent demand, but the overall market reaction was muted, indicating that investors do not expect a broader war or significant economic disruption at this stage.

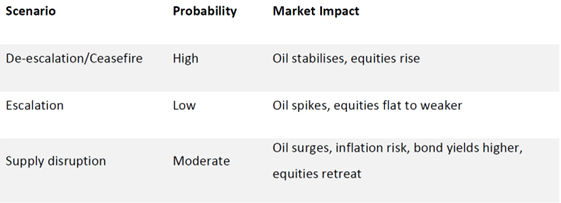

Scenarios:

Conclusion

The market’s muted reaction to recent events underscores a belief in the technological and military superiority of the US and Israel, as well as Iran’s limited capacity for broader retaliation. Investors are cautiously optimistic that the ceasefire will hold, but also remain vigilant for signs of escalation or oil supply disruption. For now, the Iranian conflict has and will likely have a limited impact on Australian and global equities as long as disruptions to oil markets remain contained and geopolitical tensions do not escalate further.

We continually monitor economic data and market movements. Our team remains dedicated to analysing these developments and their potential impact on portfolios.